Outlook

April 24, 2025

2025 Q1 Market Commentary

During the first quarter, the U.S. markets pushed to new highs only to end the quarter in a correction, subsequently experiencing a bear market decline and partial rally. What began as a growth scare has moved to real concerns of a recession. The main drivers of the downside were the release of the Chinese DeepSeek AI software in January, several inconsistent data points, and the aggressive “America First” tariff policy. Sentiment crashed and volatility spiked to levels rarely seen outside of recessionary periods. However, we are not in a recession and economic trends have yet to deteriorate. The job market and consumer spending remain stable, inflation is subdued, and corporate earnings overall remain supportive for now. While the probability of a recession has and will increase the longer negotiations drag on, a resolution of trade deals should occur before irreparable economic damage is done.

We have seen crises before and guided our clients through to the other side. This time it is no different. We see a path forward and are optimistic. Our view remains that a patient, long-term view is the best service of our clients. Empirically, it is not prudent to participate in market panics. The best days always cluster after the worst. We understand the risk. We are taking steps to adjust portfolios and are prepared for more drastic measures, if necessary.

On January 20th, a Chinese AI model known as DeepSeek was released, challenging what is arguably the most powerful economic trends since the creation of the internet. While not necessarily better than domestic applications, it’s novel architecture supports a dramatically lower cost both in dollars and energy consumption for computing. This caused a massive reset of expectations around the magnitude of spending and scale of energy and infrastructure to support AI uses. While implications create short-term uncertainty of oversupply, the market has overreacted. The development should instead be viewed through the lens of Jevons Paradox: a theory named after the 19th-century economist William Stanley Jevons, which states that increased efficiency in resource use can paradoxically lead to higher, not lower, consumption of that resource. Subsequent company earnings and announcements have supported the existing trends. The longterm AI theme is not dead, and innovation continues.

The euphoria following the November elections and expectations for pro-growth policies were overshadowed by uncertainty due to the Trump administrations aggressive trade policies. The market, which until the April 2nd announcement had expected and digested incoming tariffs, was caught off guard by the size and scale of the announcement rates. The response was exacerbated by the unpredictable and, at times, divergent messaging from the administration. A panic in the markets followed, with the S&P 500 falling 10% in two days. The bond market followed Equites and plunged several days later. These declines ranked among the fastest and most severe in history.

On the bright side, the administration responded to the market stress. They paused tariffs on countries willing to negotiate and have since tempered messaging. They want to make deals to not create a recession. Following the tariff pause, the S&P 500 rose +9.5% and the NASDAQ +12.2%, the respective third and second largest daily percentage gains in history. Despite Trump’s unpredictability, there are rational players involved and parties willing to negotiate. He may have underestimated the market’s tolerance, but we do not believe the administration will push past a point of no return. We find comfort in the emergence of Treasury Secretary Bessent’s involvement in negotiations and communication as a strong voice of reason. Deals will be made but time is of the essence. Once markets can see a path out of this mess they will recover.

The most important difference between this crisis and those over history is its self-inflicted nature. There was nothing structural in the financial system that “broke”, there was no runaway health crisis, overleverage, and the market was nowhere near overheated to bubble territory seen in crashes like 1929 or 2000. The closest comparisons we are comfortable making is Covid. Like today, we entered the crisis with a strong economy and markets. Aside from the terrible loss of life, the economic impact was due to government interventions and the resulting impact of supply chains shutting down. Once a path to lifting those restrictions could be seen, markets recovered. Peak to trough, the market fully recovered in 5 months with much of the move higher occurring in less than three. Historically, quick falls are followed by quick recoveries. Today, we are seeing similar levels of uncertainty around global supply chains. With no change to the current conditions, it is hard to argue that sufficient trade will continue to avoid massive economic damage. With the stroke of a pen, the threat can be lifted, economies can adjust, and markets recover.

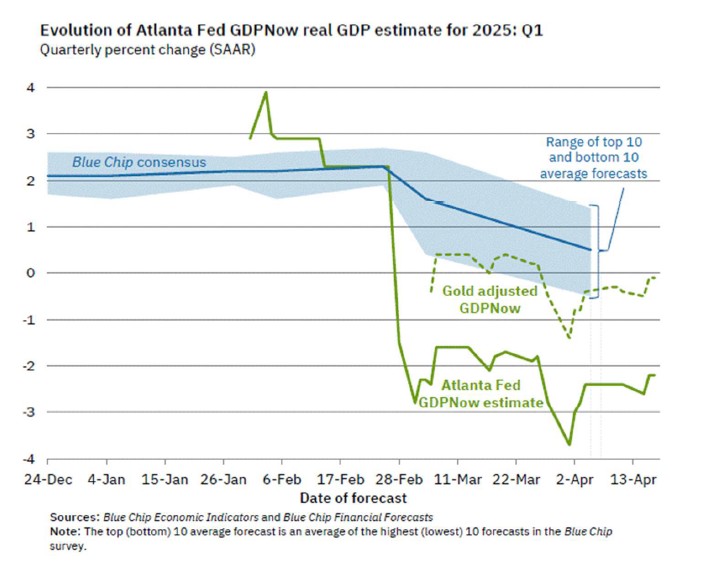

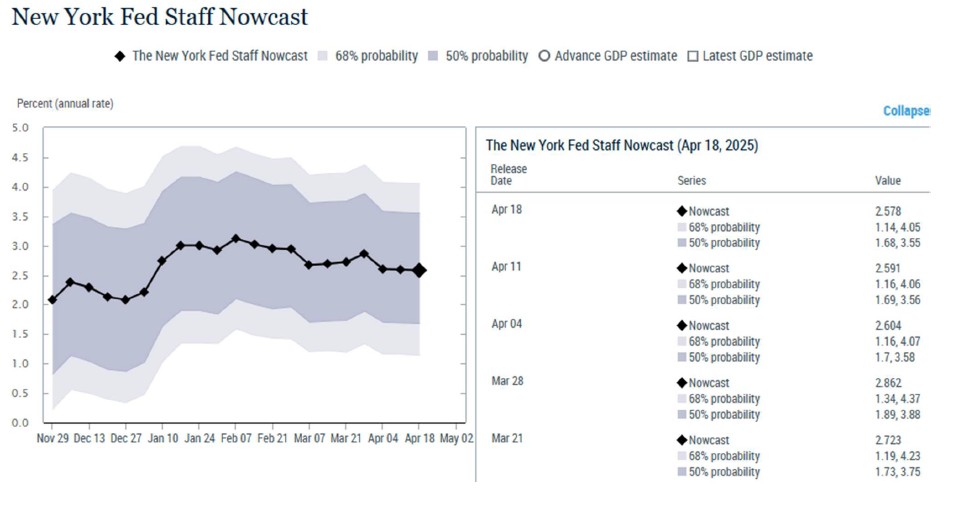

The U.S. economy entered the year from a position of strength. Q4 2024 GDP came in at +2.4%. As of April 18th, the Atlanta Fed’s GDPNow model estimate for real GDP -0.1%. Adding to recent data volatility, their model notably required an after the fact revision for unusual gold transfers (Chart 1). However, the New York Fed’s Nowcast model is estimating +2.58% GDP for Q1 and Q2 (Chart 2). Manufacturing and Services PMI have weakened but both remain neutral for growth and within recent ranges.

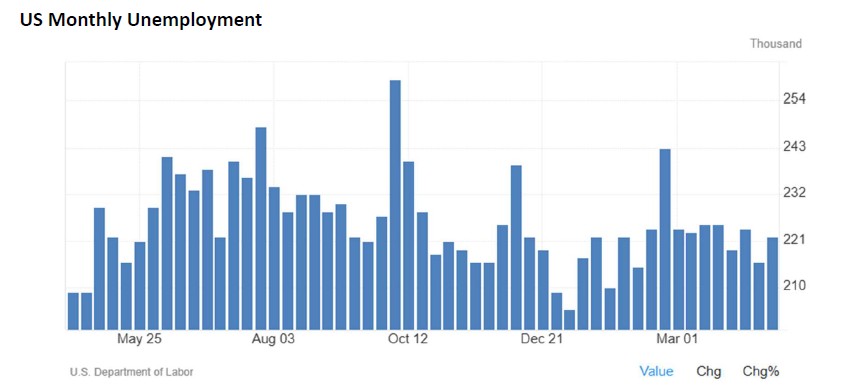

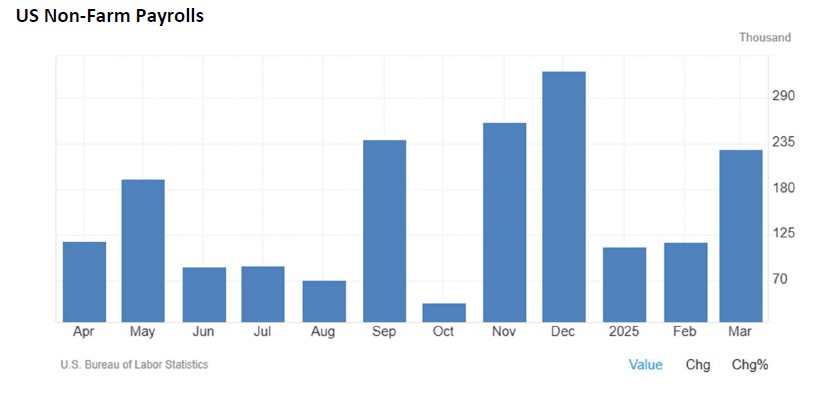

The labor market is still stable. The U.S. unemployment rate rose to 4.2% in March, from 4.1%, remaining in a tight range since last June. The 4-week average of initial jobless claims has not been concerning and is holding at ~220k (Chart 3). Nonfarm payrolls grew by 228k in March and February was revised higher (Chart 4). Average wages continue to outpace inflation. Retail sales also continue to hold with March surprising to the upside at +1.4%, ex-autos +0.5% (Chart 5). A recession should be avoided if the labor market holds.

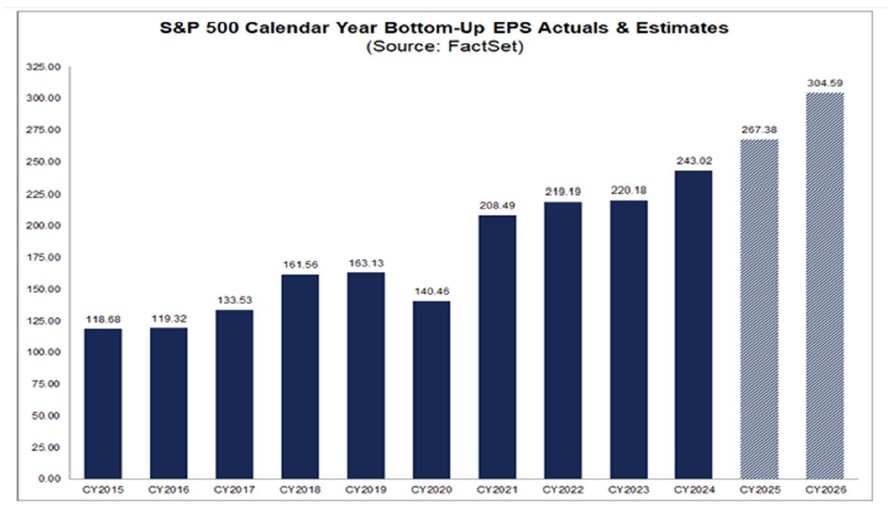

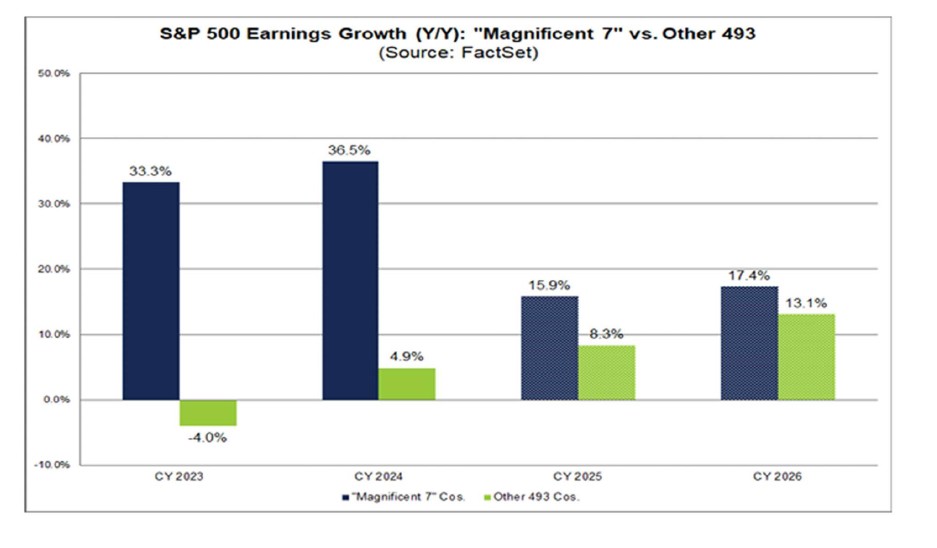

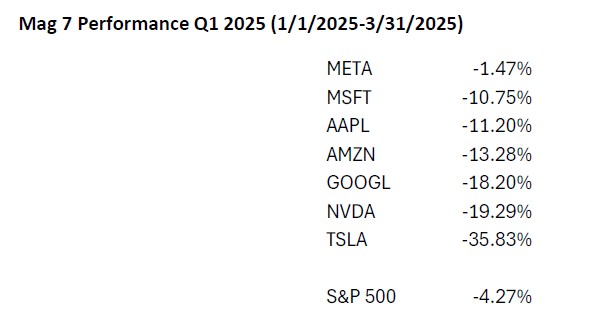

For Q1 2025, according to FactSet’s April 17th Earnings Insight, the estimated year-over-year earnings growth rate for the S&P 500 is +7.5%, down from ~11% at the beginning of the year. Revisions have been lower reflecting uncertainty with the full calendar year guidance now +10.0% (Chart 7). Notably, the Mag 7 earnings and estimates continue to significantly outpace the rest of the S&P 500 despite their massive underperformance year to date (Chart 6). Reports have been coming in better than feared, helping to support the recent rally, but we will need to see forward estimates stabilize in order to support upside, which will require progress with tariffs. Further delays or escalations will bring lower estimates.

Valuations have fallen along with the drop in sentiment. The forward 12-month P/E ratio for the S&P 500 is 19.0, down significantly from highs and now below the 5-year average of 19.9 and nearing the 10-year average of 18.3. This contraction accounts for the downside in stock prices as earnings continue to grow. Positive outcomes will depend on bond yields stabilizing and fundamentals holding. The 12-month, bottomup target for the S&P 500 is now 6704, 27.1% above Friday’s closing level of 5275.

Our playbook continues to focus on significant secular, cyclical, and structural trends. We favor high quality growth at reasonable prices with healthy balance sheets and are prioritizing companies with solid free cashflow. Volatility has provided opportunities to accumulate at discounted prices. We will continue to be dynamic and are prepared for more significant defensive moves if needed.

Important themes we are following are the reshoring of industry and supply chain shifts, tariff and tax policy impacts, AI infrastructure and software, new energy policy, normalizing interest rates, and deregulation.

The current situation is precarious. For now, the weight of evidence remains supportive but hinges on quick resolution to the tariff negotiations. Once deals begin to be made, the path forward will become clearer, and markets can refocus on pro-growth policies and tax reform. We are optimistic but remain cautious.

Robert B. Morse

Chief Investment Officer

2.

3.

4.

5.

6.

7.